Industry Talk

Regular Industry Development Updates, Opinions and Talking Points relating to Manufacturing, the Supply Chain and Logistics.COVID-19: Impact on Oil and Gas Industry and Supply Chain

Abstract

With U.S. shale oil production companies increasing their productions since 2014 and other producers keeping to their existing pace, the oil barrel price was continually declining over the past few years. As the COVID-19 virus spread pushed China towards a lockdown; and, it being the largest importer of oil and gas, factory and transportation demand declined. Eventually the demand for oil fell bringing down the oil price further. To address the situation, the Organization of the Petroleum Exporting Countries (OPEC) convened a summit to ask the leading oil producers to cut the oil production by an additional 1.5 Mn barrels. OPEC requested the non-participating countries to follow the same guideline; but, a few countries kept producing oil at the same production level. With more countries announcing lockdowns to contain COVID-19 spread, the production rate remained steady in contrast to a steep fall in requirements resulting in a huge gap in supply and demand in the Oil & Gas Industry.

Critical Elements of the Oil & Gas Supply Chain

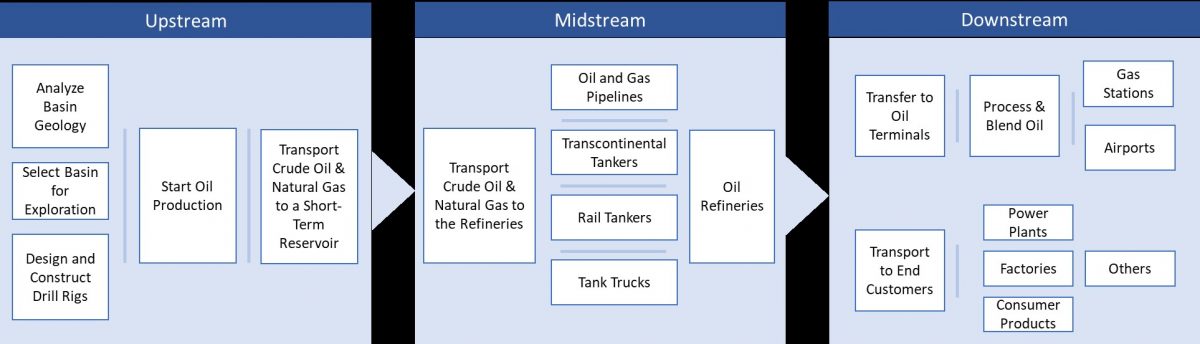

The oil and gas supply chain can be broadly divided into 3 major parts – Upstream (refers to anything having to do with the exploration of oil and gas), Midstream (refers to anything required to transport and store crude oil and natural gas before they are refined and processed), and Downstream (refers to anything involved in turning crude oil and natural gas into the finished products):

Upstream Impact & Solution Thoughts

As several major oil producers, mostly in Saudi Arabia and Russia, are not reducing their oil production due to the breakdown of talks in the OPEC summit, the major downstream supply chain impact is the availability of resources and workforce to keep the production operations and related maintenance going amid the lockdowns and other containment initiatives.

Solutions such as IOT/AR-VR enabled Remote Diagnostics and Monitoring and Preventive Maintenance using Advanced AI models could have been optimally used in such a situation to reduce dependency on the physical presence of the workforce in the production lines and to reduce the chances of a machine failure at a critical time.

Midstream Impact & Solution Thoughts

Like the oil production situation, the major oil refineries have not stopped buying oil from the exploration companies. However, due to the huge shortfall in demand in the downstream areas of the oil and gas supply chain, the transport carriers such as transcontinental tankers, rail tank cars, tank trucks etc. are getting queued up. Keeping track of the logistics, controlling the oil spillage and pilferage from the containers are exacerbating the problem in this pandemic.

There could be several solutions, based on emerging technologies, which could be deployed for near-term and long-term benefits to mitigate the situation. Remote container tracking and health monitoring can provide ready alerts for oil spillage and pilferage, and a robust fleet management can control the already over-utilized transportation modes.

Downstream Impact & Solution Thoughts

The downstream supply chain is probably the hardest hit due to the COVID-19 situation. With the sudden shortfall of demand; but, with production lines producing oil at the same rate as before, the transition market space area from the midstream to downstream is creating the major bottleneck in the entire supply chain. With COVID-19 lockdown lifted in due time, this segment will witness a massive surge in demand almost instantaneously. This will require a very robust supply and transportation planning capability to meet such demands even as the supply is overstocked.

Initiatives that could be useful to mitigate the situation are to plan for maximizing the transport utilization, smart demand-supply match, etc. Digital solutions can be designed to use advanced machine learning models to isolate end customers based on the probable demand surge, e.g. even with lifting of COVID-19 lockdown, the travel and hospitality sectors are likely to recover slowly and thereby would have less energy consumption. Such initiatives will lead to optimization of transportation focusing only on high demand or high relevant priorities.

Conclusion

Historically, the Oil & Gas industry remained skeptical to adopt digital technologies in its full potential. Only over the last few years, companies are understanding the critical need for intelligent remote maintenance in oil fields in the inaccessible areas, need of faster decisions based on advanced statistical models of drilling operations, worker safety, real time monitoring of logistics, etc. Similarly, under sudden and catastrophic circumstances, such processes, if implemented, can be optimized and utilized to mitigate adverse situations.

Sourav Saha is TCS’ Kinaxis Solution Center Lead. He has 17+ years of IT experience across various domains and technologies. He is a certified Kinaxis RapidResponse Consultant leading the Global Kinaxis Solution Practice and also Technical Architect of the Digital SCM Solution Center. Sourav has played major lead roles in several large and complex engagements across various clients, and was responsible for delivering such projects in various geographies. He is also a Certified Professional Scrum Master.