Industry Talk

Regular Industry Development Updates, Opinions and Talking Points relating to Manufacturing, the Supply Chain and Logistics.Creating a Collaborative Model for Success: Realizing the Promise of Flowcasting

Despite many collaborative initiatives and advancements in technology, out-of-stock conditions remain an industry issue. Retailers, Wholesale Distributors, and Manufacturers spend a significant amount of time and effort on forecasting and replenishment activities; but, for many, performance is at all-time low. This raises the question: are trading partners investing their effort where it really makes a difference? Many manufacturers and retailers are still operating in information silos. Each participant in the process typically creates its own forecast based on what it has sold or shipped previously. This results in an inherent forecast error that occurs at each level of the supply chain creating a bullwhip effect that leads to greater disparity between actual demand and forecasted demand causing the supply chain to become out of sync with where demand actually occurs: at the point of sale.

When consumer goods firms leverage a variety of different types of downstream data, including Point of Sale (POS) data provided by the retailers, to power more efficient supply chains, this will lead to the next wave of collaboration in demand driven supply chain management. Some suppliers are using the POS data to improve short term forecasting, particularly promotion forecasting, and to highlight points where there are breakdowns in getting promoted products onto the shelves. This can carry back to change the shipment plan between the manufacturers and retailers’ distribution centers (DCs). In reality, many manufacturers and retailers are not able to break the barriers further upstream than that.

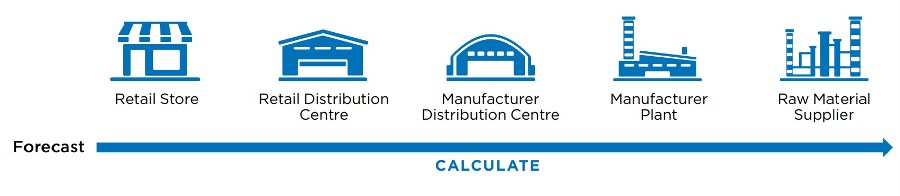

The solution to this age old problem is to work together from a single, item level forecast and plan that is executed jointly by both trading partners. When all parties involved work from one source of the truth, any changes to the forecast at POS will ripple up through the supply chain enabling the recalculation of the demand plan at each level. This ensures each supply chain participant can plan and execute its business based on the most current and accurate data available. The ultimate objective is to synchronize store level demand, assortment, and inventory across the supply chain, enabling suppliers to track their performance at retail. It requires an interconnected retail/CPG supply chain model that starts with the sell through forecast and propagates backwards. The model should understand store and retail DC reordering policies, as well as CPG manufacturing and delivery lead times. This single model of the business across the entire supply chain can be shared by retailers and manufacturers; and, it can extend to suppliers as well.

Traditional Commercial Off the Shelf (COTS) supply chain planning tools do not possess these capabilities. The problem is exacerbated when trading partners use different sets of tools when they independently optimize their supply chain. This requires a multi-enterprise planning solution built on a unitary model that allows an executable plan between the manufacturer and retailer working from a common point of view of actual store sales.

The solution should support scenario creation and comparison, particularly scenarios that support a proactive restructuring of the supply chain. For example, would the shelf level Out of Stock (OOS) numbers stay the same if the manufacturers supply chain costs dropped as the retailer ordered by pallet layers rather than by cases? It should support root cause analysis which identifies shelf level issues and assigns root-causes that can include poor perpetual inventory performance in the store, systemic over or under forecasting, and poor replenishment occurring anywhere in the joint supply chain. Overall the solution should have advanced supply chain analytics that proactively mitigate future overstocks and out-of-stocks. Trading partners that execute these actions will advance their supply chain maturity in collaborative supply chain management.

This planning philosophy is evolving from “Flowcasting” by Andre Martin, Mike Doherty, & Jeff Harrop (Factory 2 Shelf Publishing, 2006) which considers demand driven supply chain planning at its highest level of maturity driving the entire supply chain across multiple enterprises from sales at the store shelf right back to the factory.

Implementing initiatives like this require strong executive understanding, support, and commitment from both retailers and manufactures. Most important is the effort should be largely about changing business processes, paradigms and behavior. This requires an investment in educating executives, planners, merchants, operations and merchandise suppliers. Cross-functional process labs, prototypes, and pilots can help teams internalize the education and new processes to provide them the opportunity to share input and suggestions. Finally, the technology should be cloud-based to support a logical architecture enabling deep collaboration allowing an executable plan between the manufacturer and retailer working from a common point of view of what’s being sold at the store.

All trading partners will benefit from Flowcasting. When implemented correctly, the benefits are far reaching. Retailers no longer need separate forecasting and replenishment systems for their stores and Regional Distribution Centers (RDCs). One common system manages inventory in both stores and RDCs and interfaces with suppliers on a daily basis. Retail distribution centers transform over time to cross-docking and repackaging facilities. Products arrive from supply sources and are repackaged when necessary in units of weekly store sales. One common system spans cross-organizational boundaries. Store operations, merchandising, buying, category management, distribution, finance and management would all be working from a common plan.

For the manufacturer, business as usual will also change completely. The timeframe for the change would depend on the size of their retail and wholesale customers, and how rapidly those customers adopt. Over time, as more retailers adopt Flowcasting, the manufacturer would gradually transform from a manufacture-to-stock (MTS) strategy to a manufacture-to-order (MTO) strategy for much of their business while realizing the economic and productivity benefits that derive from the MTO approach. Gone would be the uncertainty of demand, associated safety stocks, and associated warehousing and operating costs as well as last minute and very costly production schedule changes and expedited transportation. For both retailers and manufacturers, supply chain-wide inventory investment would drop significantly for those retail supply chain partners that adopt the new way of doing business.